A. Forms of Relief for FPIs

The Settlement provides two types of relief for FPIs: monetary awards and a joint labor-management committee.

i. Monetary Awards

The City will pay $29,907,500 into a settlement account called a Qualified Settlement Fund (“QSF”). Subject to Court approval, distributions will be made from the QSF to pay awards to the Damages Class members and Pay Adjustment Class Members, service awards to Class Representatives, fees and expenses to Damages Class Counsel, and fees and expenses associated with the administration of the Settlement.

The parties anticipate that awards will be made in the summer of 2025. The exact timing will depend partly on how long it takes the New York City Employee’s Retirement System (“NYCERS”) to calculate Settlement Class Members’ pension contributions from their awards.

You do not need to take any action to receive your awards.

Damages Class Awards. Damages Class members will receive monetary awards based on a formula contained in section IV.5 of the Revised Stipulation of Settlement. The formula takes into account whether you were an FPI as of June 30 of each year from 2005 through 2023, what title you had at that time (new hire, incumbent FPI, AFPI I, AFPI II, or AFPI III), the difference between the average pay of FPIs at your level and the average pay of comparable construction inspectors in the Department of Buildings in that year, and the effects of interest you could have earned. The formula discounts the differences between average FPI and average construction building inspectors before 2016 because of the increasing risk that old claims may be rejected. Finally, the formula establishes a minimum award of $500.

The estimated amount of your Damages Class award is stated on the cover page of this notice. The amount may be increased if the Court reduces the requested service awards, Class Counsel fees, or expenses, or if other class members opt out. It also could be increased or decreased based on events affecting the total amount of pay adjustment awards.

Your damages award is allocated between back wages and interest based on the year you became an FPI. The longer you have been an FPI, the greater the percentage of your award allocated to interest. The percentage allocated to interest for each FPI start year is shown in paragraph IV.9 of the Revised Stipulation of Settlement.

The backpay portion of your award is “pensionable,” that is, it will be counted toward your pension as a City employee. The City and you will make payments to the pension fund just as happens for any other wages. The City also will pay the employer’s share of employment taxes. Your share of employment taxes will be deducted from your award and your estimated income tax liability on the award will be withheld.1 If the withholding is inadequate, you will be responsible for payment of additional income taxes, just as with any other wage payment.

1Tax withholding from both Damages and Pay Adjustment Awards shall take place at the single zero rate. Should you want a different withholding rate, you may contact the Administrator at (833) 419-0976 or [email protected] to address submitting a W-4.

The interest portion of your award is not “pensionable.” Neither you nor the City will pay employment taxes for the interest portion of your award. No money will be withheld for income tax liability, but you will be responsible for payment of income taxes on the award.

Pay Adjustment Class Awards. Pay Adjustment Class members will receive pay adjustment awards from the settlement account for the period from September 1, 2023, through February 14, 2025.

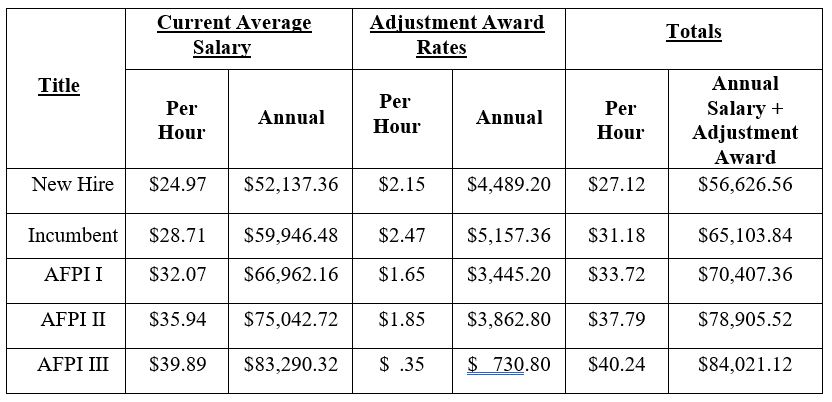

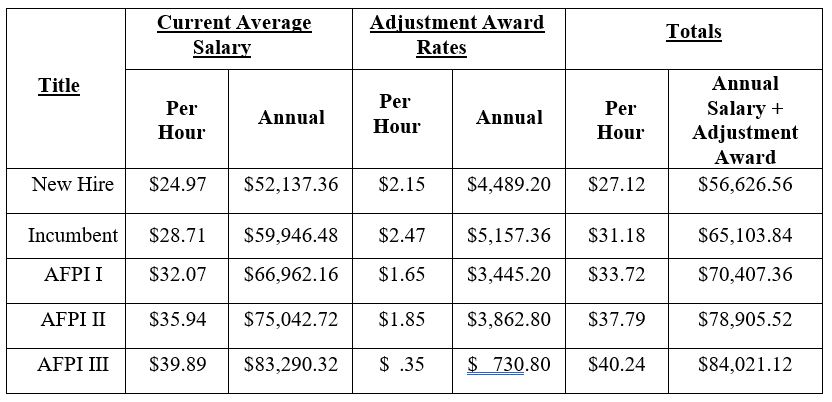

The pay adjustment hourly rates are based on the differences between the average salaries of FPIs in 2023 and the average salaries of corresponding levels of construction building inspectors, although the adjustment awards for new hires and incumbents are altered to maintain the 15% differential between new hire and incumbent pay. The awards for new hires begin only after they graduate from the FPI Academy. The table below sets out FPIs’ current average salaries, their adjustment award rates, and the total of their salaries plus adjustment award rates:

The final amount of your Pay Adjustment Class award is not yet known because it will depend on factors such as the amount of overtime you work during the Pay Adjustment Period and whether you work less than the full 17 and one-half months as an FPI, for example if you take unpaid leave or retire. If you work all 17 and one-half months without any overtime or any unpaid leave, your award (subject to withholdings as discussed below) will be the amount of the hourly adjustment times 3,045 hours. That is the figure shown above.

But the figure above could be far too high if you work less than 17 and one-half months or far too low if you work a lot of overtime. The amount you receive will be based on your actual work record.

You will have an opportunity to object if you believe that the City’s records are incorrect concerning your hours worked or overtime.

Unlike the Damages Class award, the entire Pay Adjustment Class award will be treated as wages, not wages and interest. As such, the entire award is “pensionable.” The City will pay the employer’s share of employment taxes. Your share of employment taxes will be deducted from your award and your estimated income tax liability on the award will be withheld. If the withholding is inadequate, you will be responsible for payment of additional income taxes, just as with any other wage payment.

ii. Labor-Management Committee

The Settlement Agreement also establishes a labor-management committee. The committee will address issues of concern to FPIs in Local 2507. The committee will work to ensure that FPIs are treated with a level of respect that matches their meaningful contributions to the FDNY and the City.

B. Release of Claims

If you are a Settlement Class member and do not “opt out” of the Settlement, you will release claims that the City discriminated in pay against you as an FPI because FPIs were primarily people of color. The release covers the period from the later of July 1, 2004, or your start date, until the earlier of your last date as an FPI or February 14, 2025. The back of any check that you receive will reaffirm your release. You are not releasing any other types of claims against the City.